Navigating the conventional mortgage market can read more be a daunting process. Despite this, private lending solutions offer an viable option for individuals to obtain their dream homes. These tailored loan options can provide the funding you demand to transform your vision into a home. With favorable interest rates and simplified approval processes, private lending can be the key to unlocking to your perfect property.

- Discover the benefits of private lending for your unique needs

- Connect with experienced private lenders who understand your aspirations

- Empower yourself of your homeownership journey with a private lending solution

Dodge the Banks: Private Home Loans for Unconventional Financing Needs

Are you facing traditional mortgage roadblocks? Do you require funding outside the confines of typical lending practices? Explore the world of private home loans! These financing offers an alternative path for those seeking unique or customized mortgage options. Private lenders often provide more flexibility in terms of credit requirements, property types, and loan amounts. Whether you're a first-time homebuyer with an unconventional financial situation, private loans can provide access dream homes that might otherwise be out of reach.

Bridging the Gap

Private mortgage funding has emerged as a powerful force in the financial landscape, disrupting the traditional lending paradigm. This innovative approach directly connects borrowers seeking financing with private lenders, bypassing the conventional institutions. By streamlining intermediaries, private mortgage funding offers a more efficient and flexible lending experience.

This independent connection empowers borrowers to access funding that may not be readily available through traditional institutions. Moreover, private lenders often possess a greater willingness to consider unique profiles, making it an attractive option for those with less-than-perfect credit histories or unconventional financial situations.

The rise of private mortgage funding has created a evolving market that benefits both borrowers and lenders. Borrowers gain access to favorable interest rates, quicker approval times, and tailored loan terms, while lenders can diversify their portfolios by investing in a thriving market.

Tap into Equity & Lower Monthly Payments

Considering a private mortgage refinance? It might be the perfect solution to attain your financial goals. By refinancing your existing loan, you can harness the equity built in your home to fund major expenses or carry out much-needed renovations. Plus, with current interest rates moving, you could potentially acquire a lower monthly payment, freeing up funds for other priorities.

- Private mortgage refinancing allows homeowners to utilize their equity and reduce monthly payments.

- With strategic refinancing, you can invest your newfound financial flexibility.

- Consider the possibilities of private mortgage refinancing today and unearth how it can benefit your unique situation.

Navigating the Landscape of Private Mortgage Options

Securing a mortgage is a significant financial decision for many individuals. While conventional financial institutions offer widely available options, private mortgages present an option. Understanding the details of this market can be challenging, but it can also unlock opportunities not readily found in traditional lending. Private lenders often provide customized loan structures that may cater the specific needs of borrowers who don't qualify the criteria of conventional providers.

Before venturing on a private mortgage journey, it's crucial to perform thorough research. Compare conditions from diverse lenders, meticulously review loan documents, and consult professional guidance to make an well-considered {decision|.

Bespoke Financial Arrangements for Unique Property Investment Goals

Private lenders are gaining prominence in the property investment landscape, offering tailored financing solutions to cater to specific investment goals. Unlike traditional lenders, private sources often possess a greater willingness to evaluate non-traditional assets and meet the specific needs of clients. This allows for more expansive range of investment approaches to be implemented, unlocking opportunities that may not be accessible through conventional financing avenues.

In instances where an investor seeks to obtain a property with non-traditional features, requires short-term financing for a development project, or seeks funding outside of the limitations set by conventional lenders, private lending can provide an effective alternative. By harnessing this option, investors can maximize their financial strategies and achieve their property investment objectives.

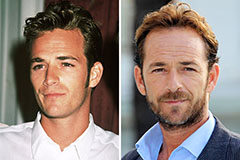

Luke Perry Then & Now!

Luke Perry Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!